How Tomorrow's Investors Trade

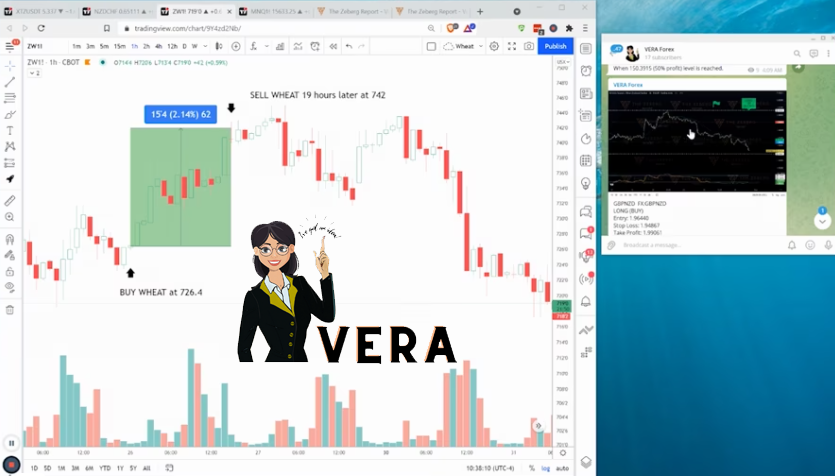

Say ‘hello’ to VERA, your personal trading assistant. Backed by 10+ years of research, real-time market scanning, and streamlined automations, VERA facilitates smarter and more profitable trading.

Ask Yourself, Do You...

- Struggle with deciding whether to hold onto or exit a position?

- Allow “analysis paralysis” to bottleneck your trading decisions?

- Miss out on investment opportunities using your unprofitable trade setup?

-

Make rash or emotional decisions during trading?

If so, you’re not alone. Countless investors worldwide are facing the same challenges day after day. That’s where VERA can help.

The VERA Advantage

VERA is a forward-leaning trading alert platform that provides automated, real-time notifications centered on consistent profitability.

Here's how VERA works...

Constant Market Scanning

While you go about your day-to-day business, VERA is hard at work seeking out and assessing the market with unmatched relevancy.

Strategic Trade Setups

By leveraging critical levels and assessing weekly and even monthly timeframes, VERA establishes key supply and demand levels.

Expedited Trades

VERA’s protocols capture 70% to 80% of every move, empowering investors to quickly transition in and out of positions while seeking out new opportunities.

What Makes VERA Different?

Before VERA, investors relied on trade alert platforms with unbalanced risk-reward ratios and inconsistent returns. Thanks to VERA’s research-backed formula and 1:2 risk-reward ratio, investors can expect consistent profits by making the right decisions just 33% of the time. Over the long term, however, VERA’s targeted win rate is 50%.

The VERA Namesake

Many investors are surprised to learn that ‘VERA’ is actually an acronym, a testament to the formulaic strategy encapsulated within the platform.

Variable - Flexibility is a fundamental pillar of VERA. In turn, investors can profit from both long-term and short-term trades. In most instances, investors will hit their profit targets anywhere from a few minutes up to a week. As a result, a portion of VERA’s trades may be considered day trades.

Empirical - VERA’s creation is the culmination of years of empirical research, careful risk assessments, meticulously selected indicators, long-term and short-term pattern evaluations, and more. Overall, VERA takes a multi-faceted approach to trading with calculated effectiveness.

Real Time Alerts - For traders, timing is key. VERA mitigates risk through a private Telegram channel. By subscribing, traders can explore newly released trade setups that generate tangible results. Simply pin the channel to the top of Telegram and enable notifications for real-time alerts.

Supporting Multiple Asset Classes

VERA tracks a myriad of asset classes, providing a heightened level of diversity compared to legacy trade alert platforms. VERA’s growing repertoire includes:

- Crypto - Providing 24/7 coverage for major and minor cryptocurrencies with alternative pairing options against USD and USDT. VERA incorporates diversification beyond Bitcoin alone, surveying major exchanges like Binance, CoinBase, Gemini, and Kraken.

- Forex - Supporting trades from Sunday night through Friday by monitoring international currencies, evaluating risk, determining entry and exit points for specific currencies, and providing strategic recommendations.

- Commodities - Evaluating investment opportunities for commodities, bringing a new and innovative approach to the oldest form of investing.

Audited Performance Results

- Crypto: 28.7% GAIN

- Forex: 12.7% GAIN

- Commodities: 0.5% LOSS

Audit Rules: Two week period ending Aug., 26, 2021. Assumes all trades within each category that reached their entry points. Some trades never reached their initial entry points and did not "trigger', hence are not included.

Pricing

Every plan comes with a FREE 14-day trial

Frequently asked questions

Do I need to provide my phone number to receive VERA alerts?

Not at all! Our VERA alerts are sent via Telegram. Download Telegram here. There are versions available for Windows, iOS, Android, and others.

Is there any user documention for VERA?

Yes! Our VERA User Manual can be downloaded here (version 1.3, dated August 31, 2021). It is not required reading in order to successfully trade the alerts. It is simply a guide to gain a better understanding of the system and includes suggestions for risk management.

What if a trade is triggered with a higher or lower price than the entry point?

Although entry points do not need to be exact, entering trades as close as possible to the entry line is recommended. If the price is within 10% of the entry line in either direction, an alert will trigger. For long positions, entering slightly above the entry line is preferred. Likewise, for short positions, entering slightly below the entry line is preferred. Oftentimes, the entry line represents either resistance or support. In turn, entering when the line has been crossed is recommended, but not required to earn profits. Throughout the process, keep the risk-reward ratio in mind while giving the trade sufficient room to grow.

If a trade that was once profitable is now below the entry point but above the stop loss level, is selling recommended?

Yes. In this situation, selling is recommended even if the trade is above the stop loss. If an investor would still like to hold, placing a hard stop order is recommended. After being stuck in a trade for two days or more, a shake out is probable. No matter if the stock bounces off the stop loss and continues to decline or falls in one fell swoop, investors are in a position of increased risk.

What if a trade is triggered for a stock position that I’m actively invested in, albeit with a different entry, target, or stop loss?

In this situation, allowing the current trade to play out while accepting the new trade through a different instrument is recommended. As a word of caution, entering into closely correlated positions or crowding a single position can lead to undesirable cost averaging and result in a plateau or loss.

I entered a new trade that triggered today. But when I scrolled back in the Telegram messages from a few days ago I noticed the exact same trade triggered then as well. You mention in the user manual that any trade over 2 days in length not yet in profit should be exited. What do I do in this scenario?

We use the "2 days rule" for trade length as a guide, for risk mitigation and best "application of capital" more than anything else. Even though the trade triggered a few days ago, the trading range still applies and the trade is still valid, so it is best to use the "2 days rule" starting from when you first entered the trade, not from when the trade initially triggered.

© Copyright 2025 by The Zeberg Report. All Rights Reserved.