Gold & Silver mining companies will be one of the best (and safest) investments of the 2020s

You have probably heard it many times before. Gold and silver are both WAY undervalued. This isn't a unique opinion. Given our central bank-driven, "print-money-out-of-thin-air" environment, most investors would agree.

Here's where our opinion differs from the herd: before they take off to the upside for good, years of intense research has shown us that precious metals will have one final, swift move down. At that point, most of the world will think gold and silver are "dead relics". That will be our cue to start accumulating the absolute BEST investment for the next 5-10 years: the companies (we have a list of 15 of them) that actually extract these rare elements from the earth. Read on to discover why...

"History doesn't repeat, but it often rhymes" - Samuel Clemens, AKA Mark Twain

Chances are, you've heard this quote. What Mark Twain most likely meant was that history doesn't repeat in exact, precise ways. Instead, history repeats, but with subtle differences. More like a "rhyme" of events than an exact replica.

One example of history "rhyming" is the precious metals market of today, compared with the 1970s. There are, of course, subtle differences between the two. But today's outlook is very reminiscent of fifty years ago. Why?

The United States in the 1960s and 1970s was involved in wars on two fronts: the Vietnam War and the Cold War. Defense spending was on the rise and became an ever-increasing percentage of the US federal budget. It took some time, but eventually this defense spending caused inflation to skyrocket. Consumer prices spiraled out of control. The economy was a complete mess.

The modern day version of this, of course, is QE ("quantitative easing", or money printing, for short). QE has been a mainstay of Federal Reserve policy -- and that of every other nation's central bank -- since 2008. Did you know that the United States printed more money in June 2020 alone, than in the first two centuries after its founding? Just as in the past, today's central bank money printing policies WILL lead to runaway inflation -- similar to the 1970s, but potentially much, much worse.

As fiat currency quickly loses its value, naturally this will lead to a MASSIVE bull run in precious metals, unlike anything seen in the past...

...But not yet!

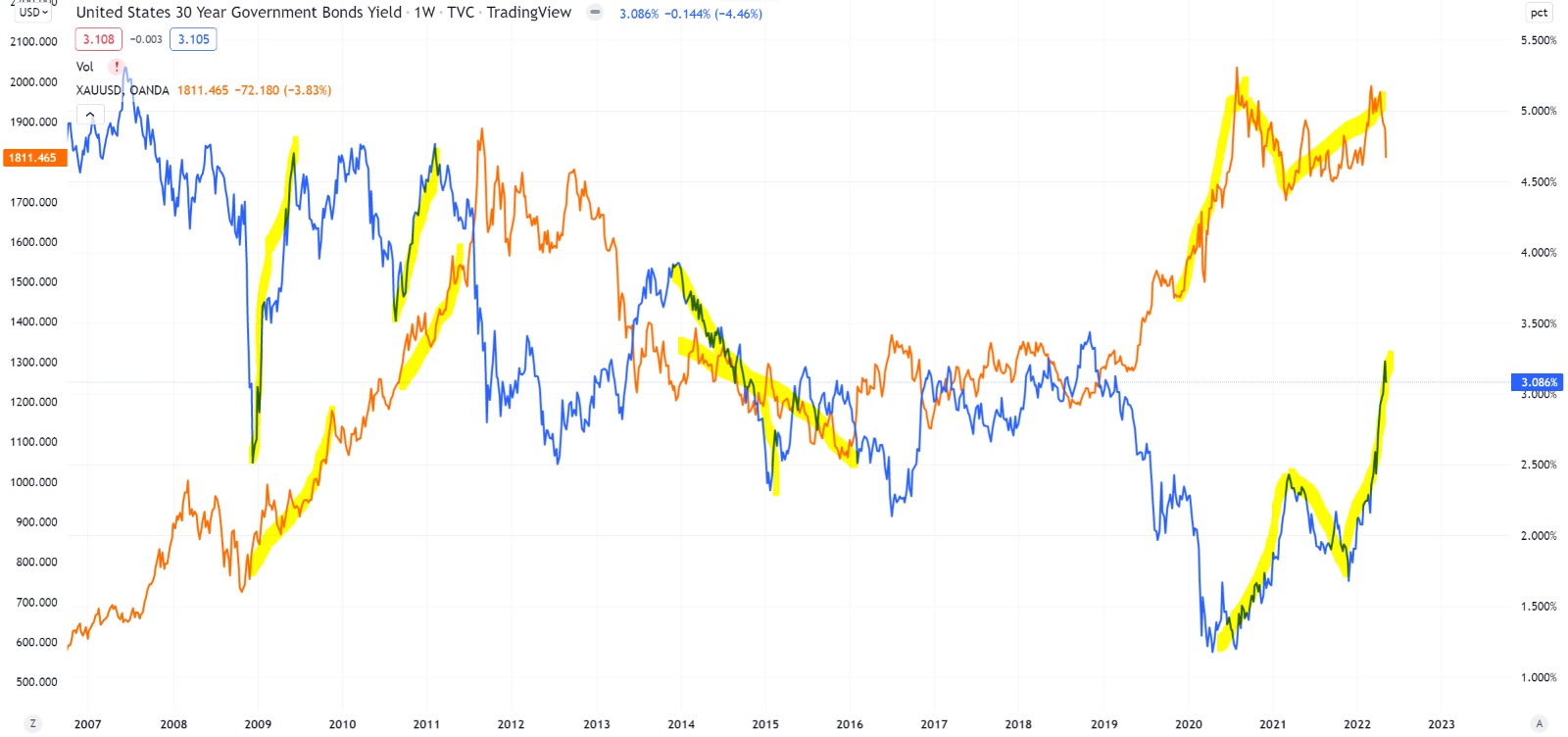

An ounce of gold (see chart above) set a new record high in August 2020 at $2075. Its prior record high was way back in September of 2011 at $1900. This must mean we are in a bull market, correct? Let's check some other data points to be sure...

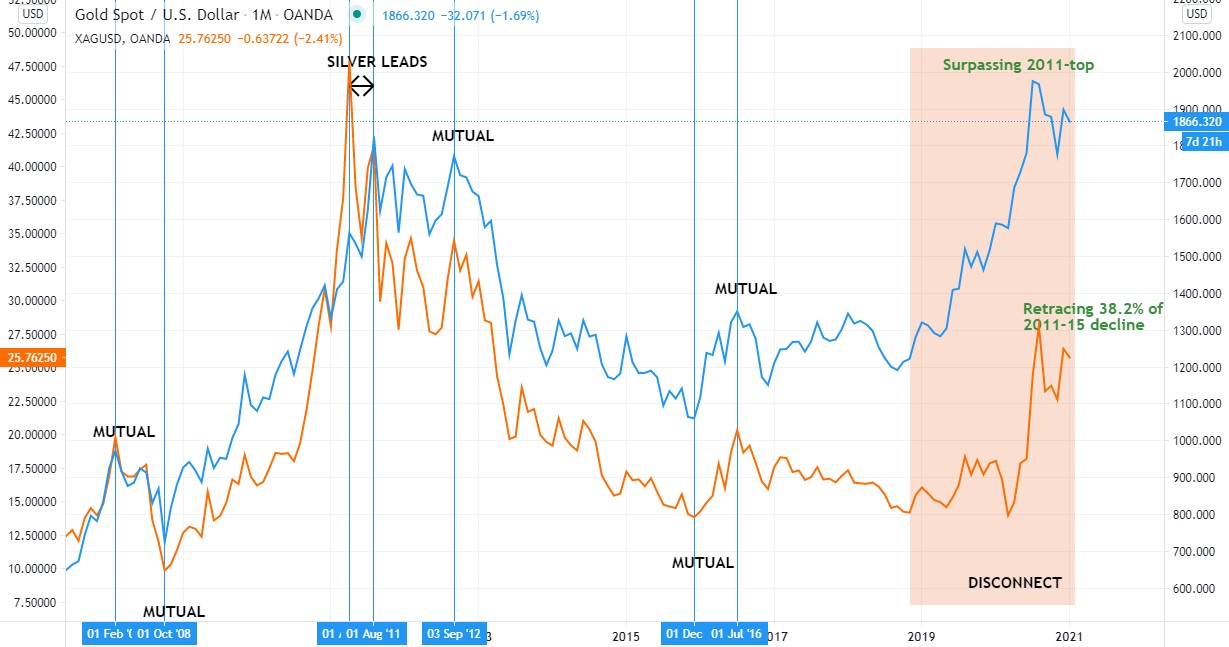

Silver's 2020 high (see chart above) was close to $30. However, this did not surpass its previous record high in 2011 of almost $50 per ounce. Something is amiss...

As you can easily see in the chart above, silver (red line) usually outperforms gold (blue line) in bull markets, as it did in 2011. But right now silver is lagging badly.

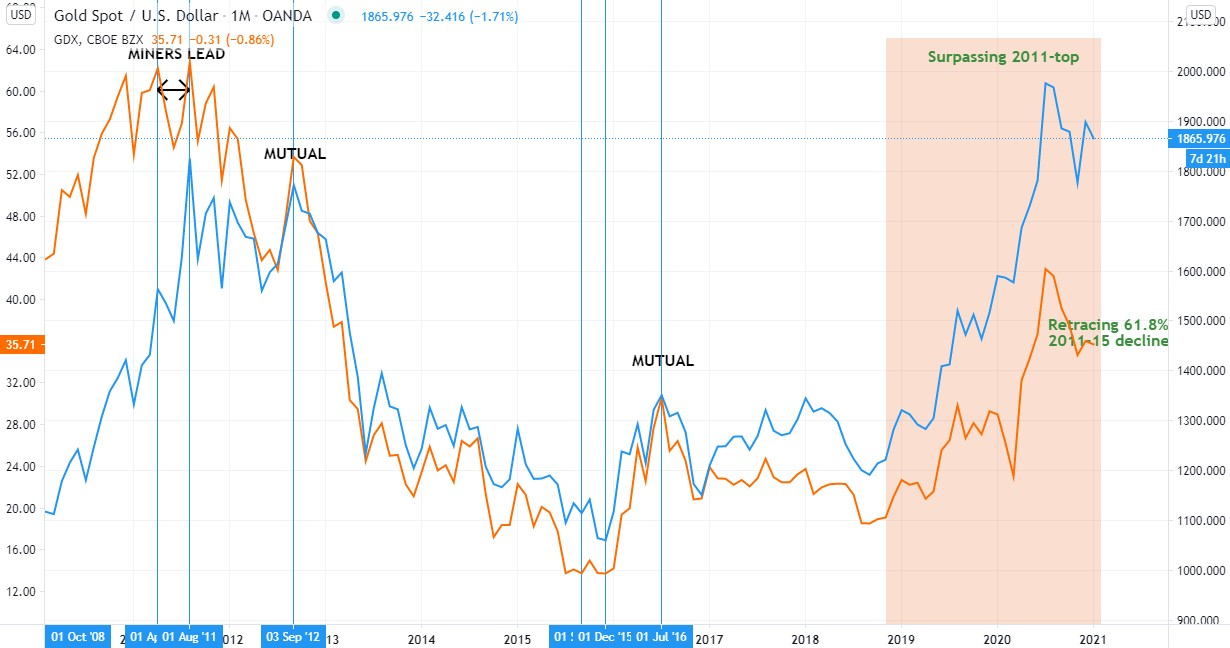

One more piece of evidence! The miners (GDX ETF above in red) usually outperform gold (blue line) in bull markets as well. But again, just like silver, the GDX is underperforming.

Bull market not here yet...

As you can see in these charts, we ARE NOT IN A PRECIOUS METALS BULL MARKET, yet! Since the highs of 2011, (even with gold making a new high) metals have been in a correction. As happened in 2008 during the Global Financial Crisis, we expect one final, swift move downward. And that is because, right now there are two things happening elsewhere in the markets that gold and silver HATE.

-

After a long downturn, the US Dollar is finally starting to strengthen against other currencies.

-

Commodities are weakening.

Both a strong dollar and weak commodities point to a coming deflationary period, which means lower prices in the short term for our metallic friends. Deflation periods tend to be swift, and involve lots of margin calls and deleveraging. Many assets get sold in order to raise cash to meet margin calls on other assets. As can be seen below, metals (especially silver) did very poorly in the 2008 crisis:

So why the "miners", anyway?

-

In any precious metals bull market, the miners are the thing to own! Of course, as metals prices go up, raw bullion appreciates in value. However, the mining companies grow exponentially in bull trends. That's because the product they sell (raw bullion) keeps rising while the associated costs of mining remain flat. Very few other businesses are like this. So every increase in raw bullion (the price consumers pay) goes STRAIGHT to the bottom line! That is the main reason they outperform the base metals. Wouldn't you love to own a business like this?

-

After gold reaches its ultimate low, we expect it to go to $5,000 per ounce and beyond. We expect silver to reach $75-$100 per ounce and beyond. These are fairly conservative estimates. Many of these mining companies (our stellar list includes 15 of them) have amazing upside, providing potential gains of up to 5x-10x! One company even has a potential of over 60x!

-

Mining companies provide a valuable service and there is always a need for their product. Not only are gold and silver crafted into jewelry, but there is an ever-growing strong industrial demand as well. Silver is a fantastic conductor of electricity, and as such is used extensively in consumer electronics. These things are not going away anytime soon!

-

Most of these companies actually pay dividends, which you can automatically re-invest to purchase more shares. We'll let you know which ones do, and how much. Warren Buffet says he doesn't own any gold and silver because they don't pay him anything (dividends). I think Warren would love our list!

-

They are stocks, which means when you buy and hold the companies there's nothing else you need to worry about. When you own bullion, you have to worry about storage costs, which can be an added aggravation.

Here's what you get!

-

Gold and Silver Miners Report July 2022, includes 15 "special opportunity" companies in the mining sector primed for a massive move up. You'll get to know the best companies in the best sector!

-

Buy price points of each

-

Our timing recommendations. We'll let you know when we see a market bottom so you can pull the trigger!

-

Recommended allocation percentages of each to help you manage your mining company portfolio

-

Long-term price targets for each (3-5 years in the future)

-

BONUS! MEMBERS-ONLY access to weekly or monthly updates for each issue, as they arise. We will provide guidance over time on how to continually play these companies, support/resistance areas to be aware of, and anything else that might affect the fundamental picture along the way

© Copyright 2025 by The Zeberg Report. All Rights Reserved.